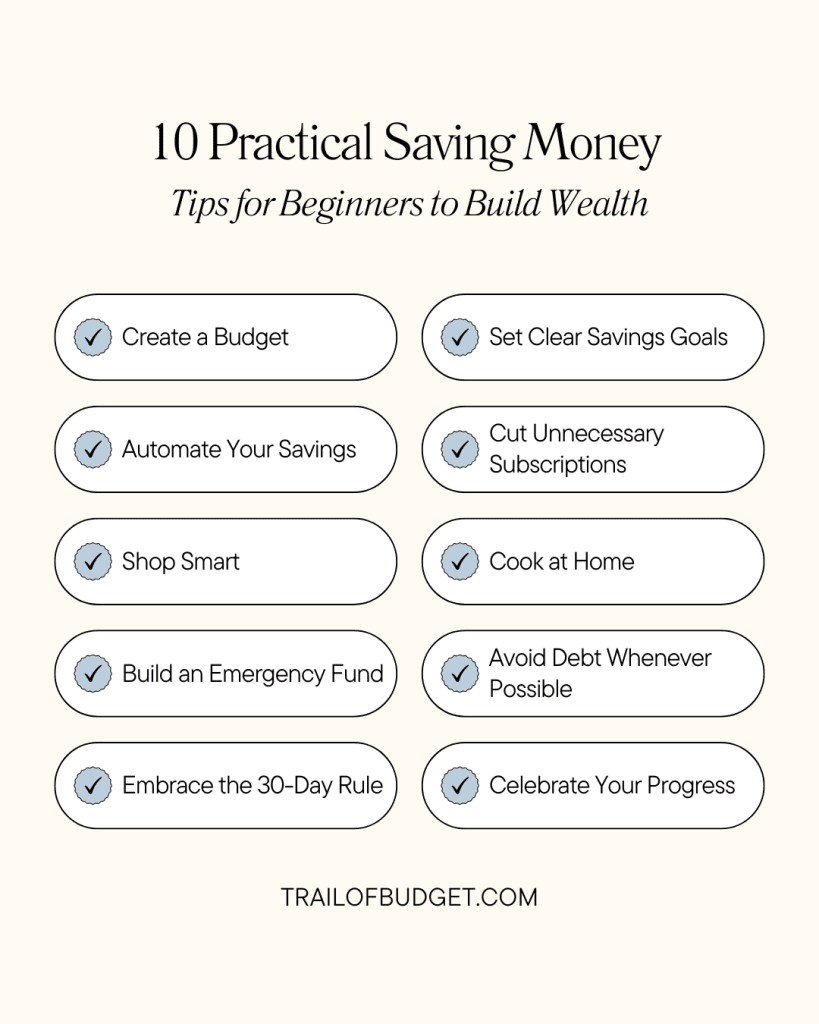

Are you tired of seeing your hard-earned money slip away with nothing to show for it? You’re not alone. Learning how to save money is a vital step toward financial stability, and with the right approach, anyone can master it. These saving money tips for beginners will help you cut unnecessary expenses, boost your savings, and set yourself up for long-term financial success. Let’s dive in!

Table of Contents

1.Create a Budget

A budget is your financial roadmap. Start by tracking your income and expenses to identify where your money is going. Use budgeting apps or tools like NerdWallet to simplify the process. Sticking to a budget is one of the most fundamental saving money tips for beginners.

2. Set Clear Savings Goals

Define what you’re saving for—a vacation, a new car, or an emergency fund. Having clear goals makes saving money more purposeful and motivating. For example, setting aside just $100 a month can lead to $1,200 saved in a year!

3.Automate Your Savings

Take the guesswork out of saving by automating it. Set up automatic transfers from your checking account to your savings account every payday. This ensures you’re paying yourself first, which is a key principle in every list of saving money tips for beginners.

4.Cut Unnecessary Subscriptions

Review your monthly subscriptions, like streaming services, gym memberships, or even app subscriptions. Take a closer look at what you’re actually using versus what’s just silently draining your wallet. Cancel the ones you don’t use regularly or consider downgrading to a more affordable plan if possible. Small changes like this can free up extra cash for savings, which you can redirect toward achieving your financial goals or building an emergency fund. Over time, these adjustments can add up to substantial savings without significantly impacting your lifestyle.

5.Shop Smart

Always compare prices before making purchases, and take advantage of discounts, coupons, and cashback offers. Planning your shopping trips can also help you avoid impulse buys.

6.Cook at Home

Dining out can quickly drain your wallet. Cooking meals at home not only saves money but also allows you to eat healthier. This is one of the easiest and most impactful saving money tips for beginners.

7.Build an Emergency Fund

Life is unpredictable, and having an emergency fund can protect you from financial stress. Start small, aiming for at least $500, and gradually increase it over time.

8.Avoid Debt Whenever Possible

Pay off your credit card balances in full each month to avoid interest charges. If you have existing debt, prioritize paying it down as quickly as possible.

9.Embrace the 30-Day Rule

Before making a non-essential purchase, wait 30 days. This cooling-off period helps you determine if you really need the item or if it’s just a fleeting desire.

10.Celebrate Your Progress

Saving money takes discipline, so celebrate your wins—big or small. Treating yourself occasionally can keep you motivated to stay on track.

Conclusion

Mastering these saving money tips for beginners is not about making drastic sacrifices but about being mindful of your financial decisions and creating sustainable habits. By focusing on small, intentional changes, you can make a significant impact on your financial well-being without feeling overwhelmed. Each step you take, whether it’s tracking your expenses, setting clear goals, or cutting unnecessary costs, brings you closer to achieving your financial dreams and securing a brighter, more stable future.

Start implementing these tips today, and you’ll soon see the positive effects on your savings and overall peace of mind. Remember, every small step adds up to significant progress, and over time, these efforts will compound into something truly rewarding. Financial freedom isn’t just a dream—it’s a goal that’s achievable with consistency, patience, and a little determination. Begin your journey now, and take control of your financial destiny!

If you’re just starting on your journey to financial freedom, understanding the basics of budgeting is essential. Check out our comprehensive Budgeting Basics Guide to learn how to create a budget, track expenses, and take control of your finances. It’s the perfect starting point to build a solid foundation for managing your money effectively.

5 thoughts on “10 Practical Saving Money Tips for Beginners to Build Wealth”