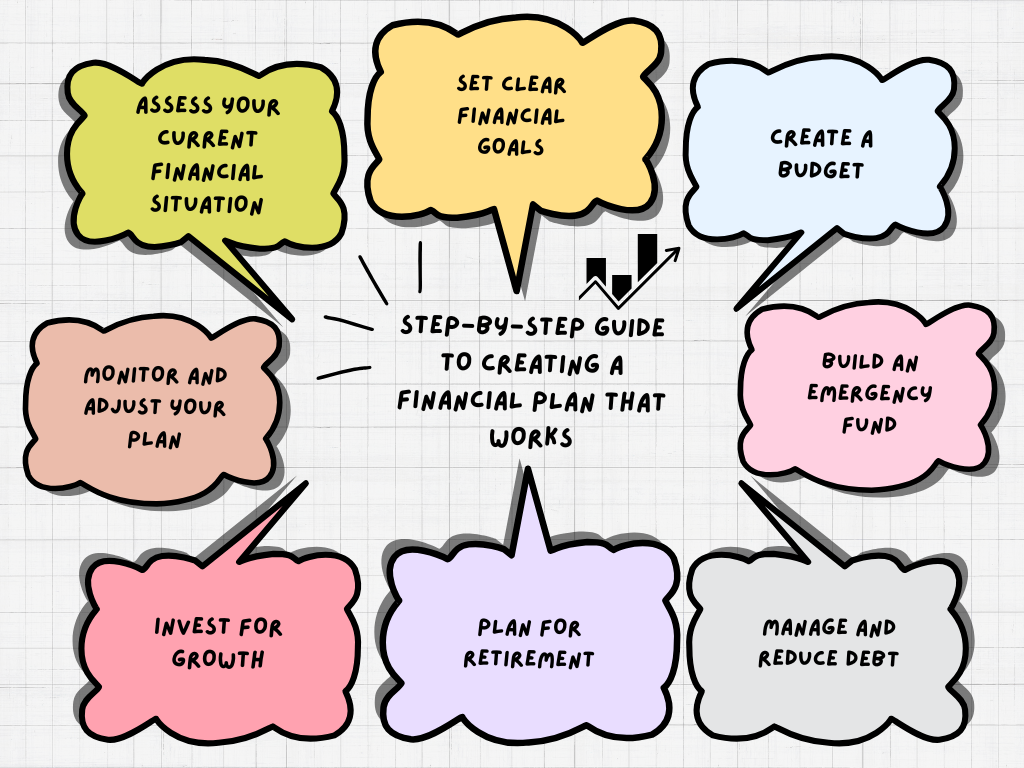

A solid financial plan is essential for achieving your short-term and long-term goals. Whether you’re saving for a big purchase, paying off debt, or planning for retirement, having a clear roadmap can make all the difference. Here’s a step-by-step guide to creating a financial plan that works for you.

Table of Contents

1.Assess Your Current Financial Situation for a Financial Plan That Works

Before you can create a plan, you need to understand your starting point. Gather all relevant financial information, including your income, expenses, debts, and assets.

- Track Income and Expenses: Use tools like spreadsheets or budgeting apps to record your monthly cash flow.

- Evaluate Debts and Assets: List all your debts (credit cards, loans) and assets (savings, investments).

- Quick Tip: Create a net worth statement by subtracting liabilities from assets.

2.Set Clear Financial Goals for a Financial Plan That Works

Defining your goals will help you prioritize your spending and saving. Goals can be short-term, medium-term, or long-term.

- Short-Term Goals: Examples include building an emergency fund or paying off credit card debt.

- Long-Term Goals: Retirement planning, buying a home, or funding education.

- SMART Goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

3.Create a Budget

A budget is the backbone of any financial plan. It ensures you’re allocating money effectively toward your goals.

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

- Track Spending: Use budgeting apps like YNAB or Mint to monitor expenses.

- Adjust Regularly: Review and tweak your budget monthly to reflect changes in income or expenses.

4.Build an Emergency Fund for a Financial Plan That Works

An emergency fund provides a safety net for unexpected expenses, such as medical bills or car repairs.

- Set a Target: Aim to save 3-6 months’ worth of living expenses.

- Automate Savings: Set up automatic transfers to a dedicated savings account.

- Start Small: Even saving a small amount regularly can add up over time.

5.Manage and Reduce Debt

Debt management is a crucial part of financial planning. High-interest debt can hinder your ability to save and invest.

- Prioritize High-Interest Debt: Pay off debts with the highest interest rates first.

- Use Debt Repayment Strategies: Consider the snowball or avalanche method.

- Avoid New Debt: Limit credit card usage and focus on paying off existing balances.

6.Plan for Retirement

It’s never too early to start saving for retirement. The earlier you begin, the more time your money has to grow.

- Contribute to Retirement Accounts: Maximize contributions to 401(k) or IRA accounts.

- Take Advantage of Employer Matching: If your employer offers a match, contribute enough to receive the full benefit.

- Diversify Investments: Ensure your portfolio is well-diversified to minimize risks.

7.Invest for Growth

Investing is key to building wealth over the long term. Tailor your investment strategy to your goals and risk tolerance.

- Understand Your Risk Tolerance: Choose investments that align with your comfort level.

- Diversify Your Portfolio: Include a mix of stocks, bonds, and other assets.

- Seek Professional Advice: Consider consulting a financial advisor for personalized guidance. You can also visit trusted resources like Investopedia or NerdWallet for additional insights.

8.Monitor and Adjust Your Plan

Financial planning is not a one-time task. Regularly review your plan to ensure it aligns with your goals and financial situation.

- Set Regular Check-Ins: Review your financial plan monthly or quarterly.

- Adjust for Life Changes: Update your plan as your income, expenses, or goals change.

- Celebrate Milestones: Acknowledge and reward yourself for achieving financial goals.

Conclusion

Creating a financial plan that works takes time and effort, but the rewards are well worth it. By assessing your situation, setting goals, budgeting, and staying disciplined, you can take control of your finances and build a secure future. Start today and take the first step toward financial freedom.

Internal Link :

Master Your Money: Top 7 Budgeting Apps to Simplify Your Finances in 2025