Table of Contents

Introduction:

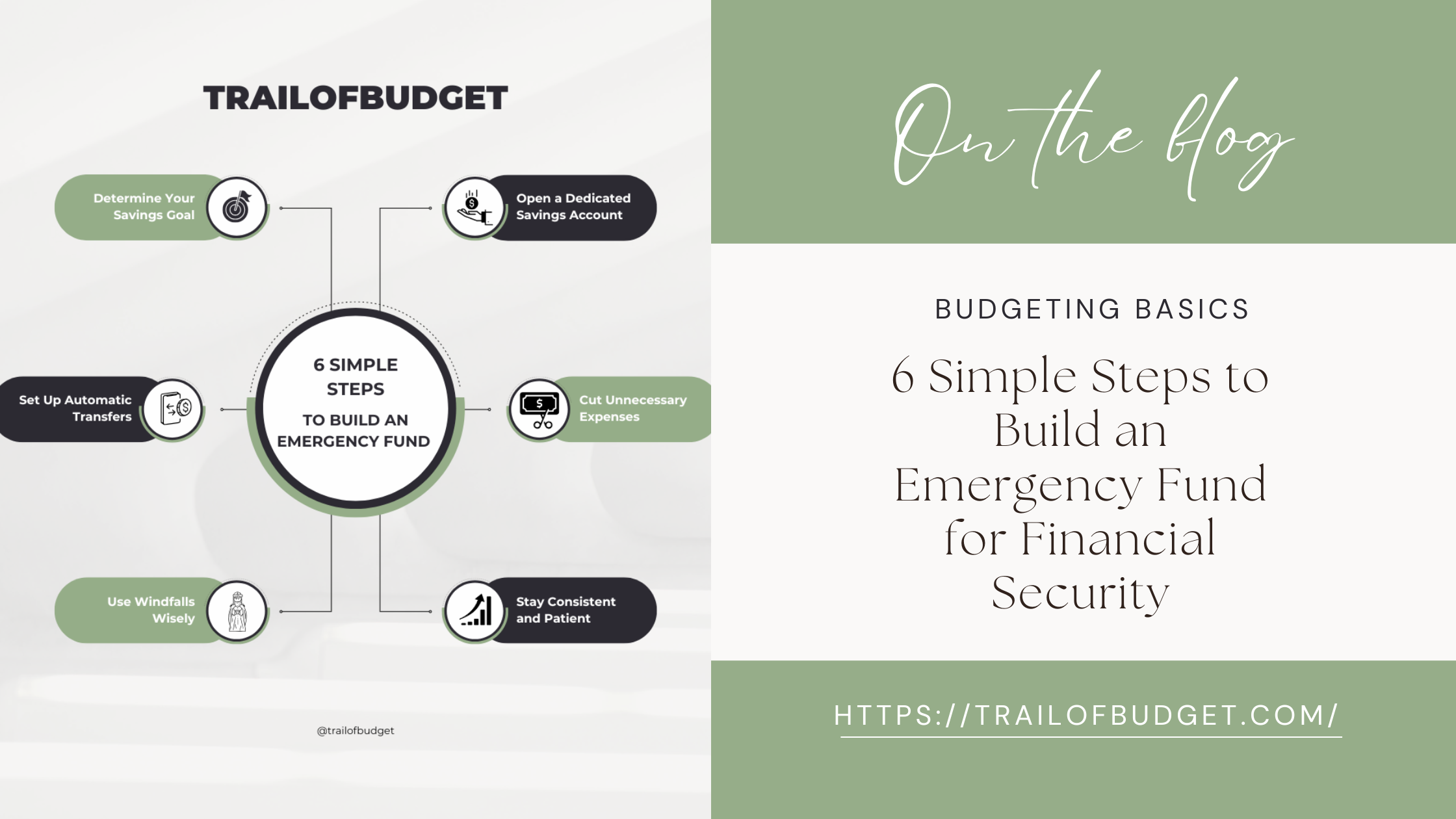

If you’re looking to build an emergency fund, you’re taking a vital step toward financial security. An emergency fund serves as a safety net for unexpected events like medical bills, car repairs, or job loss, helping you avoid debt and maintain peace of mind. In this guide, we’ll show you how to start saving for emergencies and ensure financial stability during uncertain times.

1.Determine Your Savings Goal

The first step to build an emergency fund is deciding how much you need to save. Financial experts recommend having three to six months’ worth of living expenses set aside. To calculate this, add up your essential monthly costs, including rent, utilities, groceries, and insurance. If the goal seems overwhelming, start small. Remember, every little bit you save adds up over time and brings you closer to achieving your goal to build an emergency fund.

2.Open a Dedicated Savings Account

Keeping your emergency fund separate from your regular checking or savings account helps you avoid spending it on non-emergencies. Look for a high-yield savings account that offers competitive interest rates. This allows your money to grow while remaining accessible when you need it. A dedicated account ensures that you stay focused on your goal to build an emergency fund.

3.Set Up Automatic Transfers

One of the easiest ways to build an emergency fund is by automating your savings. Set up a monthly or biweekly transfer from your paycheck or checking account to your emergency fund. Even a small, consistent amount like $50 per month can make a big difference over time. Automation helps you stay disciplined and ensures your goal to build an emergency fund stays on track.

4.Cut Unnecessary Expenses

Take a close look at your monthly expenses and identify areas where you can cut back. Cancel unused subscriptions, eat out less often, or shop for sales on essential items. Redirect the money you save into your emergency fund. These small lifestyle adjustments can accelerate your progress toward building an emergency fund without requiring drastic changes.

5.Use Windfalls Wisely

Unexpected income, like tax refunds, bonuses, or monetary gifts, is an excellent opportunity to build an emergency fund. Instead of splurging, consider depositing a portion—or all—of the windfall into your savings account. These occasional contributions can significantly reduce the time it takes to reach your goal.

6.Stay Consistent and Patient

Building an emergency fund takes time and discipline. Celebrate small milestones along the way to keep yourself motivated. Remember, the goal is not perfection but progress. Over time, your efforts will pay off, and you’ll have the financial security to handle life’s unexpected challenges. Stay consistent, and soon you’ll be able to confidently say you’ve built an emergency fund that offers peace of mind.

Conclusion:

An emergency fund is a crucial part of financial planning, offering security and peace of mind. By setting clear goals, cutting unnecessary expenses, and staying consistent, you can build an emergency fund to protect yourself and your loved ones during tough times. Start saving today, and you’ll thank yourself later for being prepared for whatever life throws your way.

Saving money doesn’t stop at building an emergency fund. You can also free up extra cash by making smarter choices in everyday spending, like dining out. If you’re looking for practical ways to cut costs without sacrificing your lifestyle, check out our guide on how to save money on dining out. Every small step you take helps you reach your financial goals faster.

For more tips on managing your finances and making smarter spending choices, check out this comprehensive guide on financial planning and budgeting.