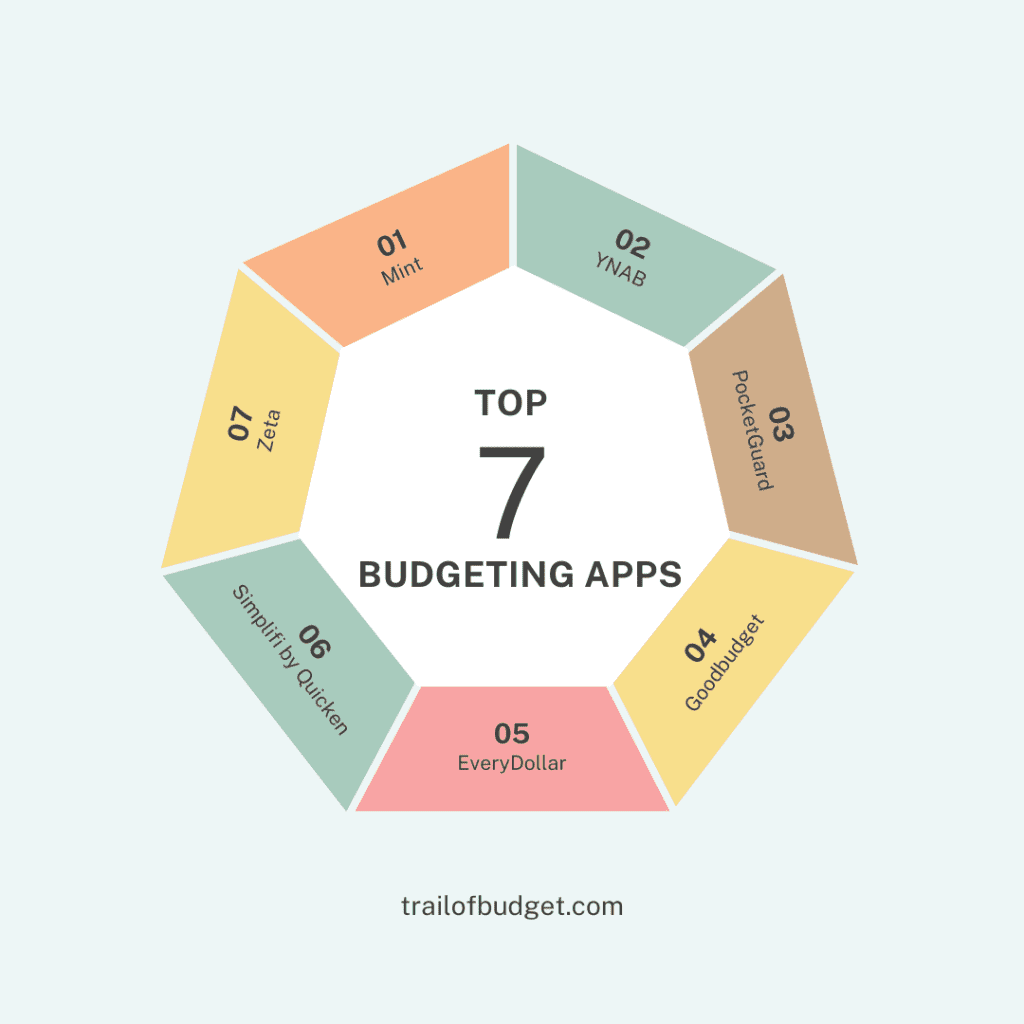

Mastering your money doesn’t have to be complicated. In fact, with the right tools, it can be surprisingly simple. This guide will introduce you to the top 7 budgeting apps to simplify your finances in 2025, empowering you to take control of your spending and achieve your financial goals.

Table of Contents

Why You Need a Budgeting App in 2025

In today’s fast-paced world, budgeting apps offer a convenient and powerful way to manage your money. They provide:

- Automated Expense Tracking: Easily categorize and track spending across various categories.

- Budget Creation & Monitoring: Set realistic budgets and receive alerts when you’re approaching spending limits.

- Financial Insights: Gain valuable insights into your spending habits, identify areas for improvement, and make informed financial decisions.

- Goal Setting & Tracking: Define financial goals (e.g., saving for a down payment, paying off debt) and monitor your progress.

- Increased Financial Awareness: Develop a deeper understanding of your financial situation and cultivate healthier spending habits.

1.Mint – The All-in-One Budgeting Champion

Mint is one of the most popular budgeting apps to simplify your finances in 2025 for a reason. It offers comprehensive features, including expense tracking, budget creation, and bill reminders. Best of all, it’s free to use.

Key Features:

- Automatic Expense Categorization: AI-powered categorization makes tracking spending a breeze.

- Credit Score Monitoring: Track your credit score and receive alerts for potential issues.

- Personalized Financial Insights: Receive tailored advice on how to improve your financial health.

- Learn more about Mint here

2.YNAB (You Need A Budget) – Master Your Money with a Zero-Based Approach

YNAB (You Need A Budget) focuses on assigning every dollar a job, making it ideal for proactive money management and simplifying your financial life in 2025. Its educational resources are perfect for beginners.

Key Features:

- Zero-Based Budgeting: Assign every dollar to a specific purpose, ensuring you spend within your means.

- Goal-Oriented Budgeting: Create and track progress towards specific financial goals (e.g., saving for a down payment, paying off debt).

- In-depth Financial Reports: Gain valuable insights into your spending patterns and identify areas for improvement.

- Explore YNAB’s features.

3.PocketGuard – Budget Smarter, Not Harder

PocketGuard simplifies budgeting by calculating your “In My Pocket” spending allowance after considering bills and savings goals, helping you master your money and stay within your budget. This app is a valuable tool for anyone looking to simplify their finances in 2025.

Key Features:

- “In My Pocket” Spending Calculator: Provides a clear picture of how much you can spend without derailing your financial goals.

- Bill Tracking & Reminders: Receive timely reminders for upcoming bill payments and avoid late fees.

- Easy Subscription Management: Track and cancel unwanted subscriptions to save money.

4.Goodbudget – Modernize the Envelope System

Goodbudget is a modern take on the envelope budgeting system, perfect for those who prefer a manual approach to simplifying their finances in 2025.

Key Features:

- Envelope-Based Budgeting: Allocate funds to virtual “envelopes” for different spending categories.

- Cross-Device Syncing: Access your budget and track spending seamlessly across all your devices.

- Detailed Spending History: Review your spending history to identify trends and make informed adjustments.

5.EveryDollar – Zero-Based Budgeting with Dave Ramsey’s Philosophy

EveryDollar, developed by Dave Ramsey, uses zero-based budgeting to help users allocate every dollar effectively, simplifying your finances in 2025 and achieving financial freedom.

Key Features:

- Drag-and-Drop Budgeting: Easily allocate funds to different spending categories.

- Budget Templates: Access pre-made budget templates to get started quickly.

- Debt Payoff Tools: Utilize tools to create a debt repayment plan and track your progress.

6.Simplifi by Quicken – Streamline Your Finances with Minimal Effort

Simplifi is designed for users who want a clean interface with powerful financial planning tools, making it easy to simplify your finances in 2025 by tracking subscriptions and savings goals.

Key Features:

- Personalized Spending Plans: Create customized spending plans that align with your financial goals.

- Comprehensive Subscription Tracking: Track all your subscriptions in one place and easily cancel unwanted ones.

- Savings Goal Management: Set savings goals and track your progress towards achieving them.

7.Zeta – The Perfect Partner for Couples: Budgeting Apps to Simplify Your Finances in 2025

Zeta is specifically designed for couples seeking to simplify their finances in 2025, facilitating shared financial management and goal setting. This app is perfect for couples who want to track joint expenses, split bills easily, and work together towards shared financial goals.

Key Features:

- Joint Account Syncing: Seamlessly sync and track joint accounts and expenses.

- Easy Bill Splitting: Effortlessly split bills and track who owes what.

- Shared Goal Tracking: Set and track shared financial goals, such as saving for a down payment or a vacation.

Tips for Choosing the Right Budgeting App for

- Define Your Goals: Determine your primary financial goals (e.g., saving for a down payment, paying off debt, reducing spending).

- Consider Privacy: Choose an app with robust security measures to protect your sensitive financial data.

- Test Free Versions: Many apps offer free trials or basic versions, allowing you to test them before committing.

- Read User Reviews: See what other users have to say about their experiences with different budgeting apps.

Internal Resources

- 10 Practical Saving Money Tips for Beginners to Build Wealth

- Best Certified Financial Planner Near Me

Final Thoughts

By leveraging the power of these top 7 budgeting apps to simplify your finances in 2025, you can gain control of your finances, achieve your financial goals, and build a more secure financial future.