When it comes to securing your financial future, finding the right certified financial planner (CFP) is crucial. A CFP can help you create a comprehensive financial plan, manage investments, and achieve long-term goals. But with so many options available, how do you choose the best certified financial planner near me? In this guide, we’ll walk you through the steps to find the perfect financial advisor to meet your needs.

Table of Contents

Why You Need a Certified Financial Planner

Certified financial planners are professionals who have met rigorous education, examination, and ethical standards. They are equipped to help you with retirement planning, tax strategies, investment management, and more. Working with a CFP ensures that your finances are in expert hands, giving you peace of mind and confidence in your financial future.

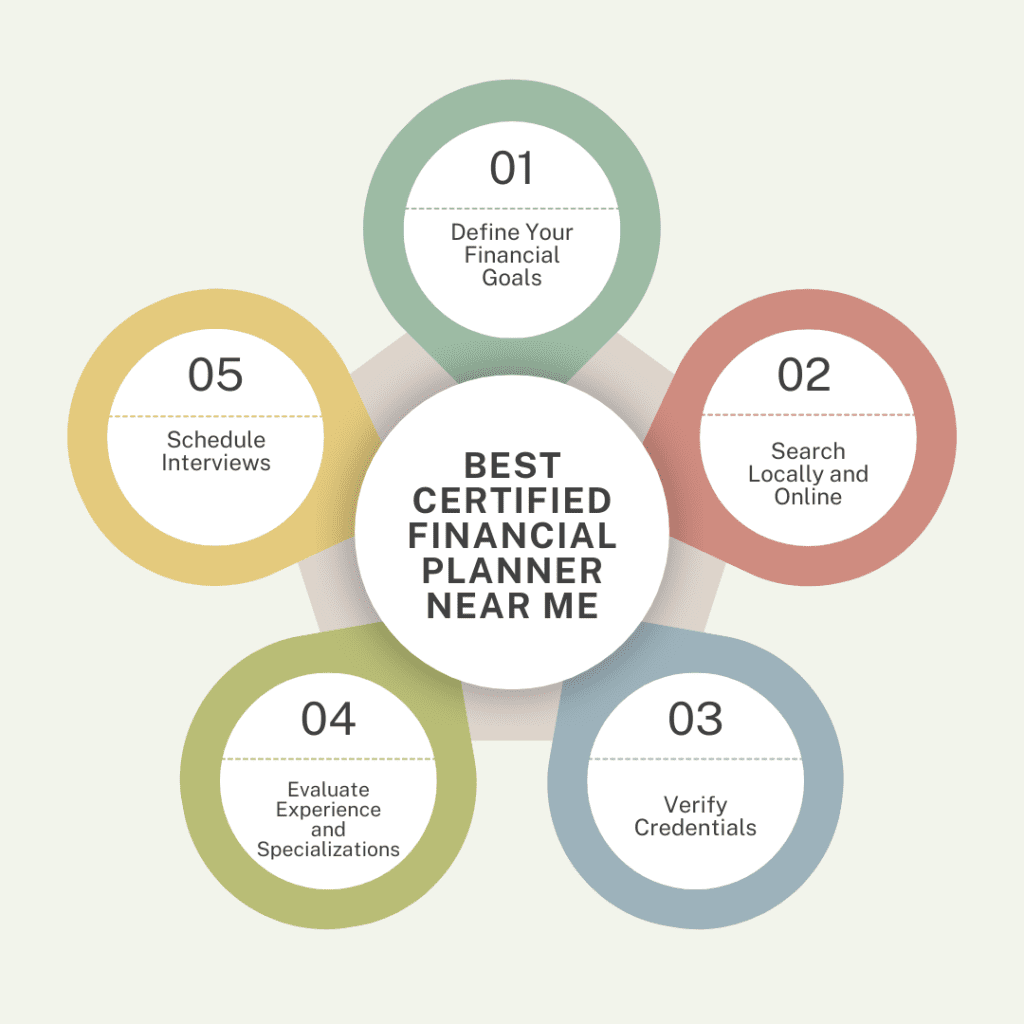

Steps to Find the Best Certified Financial Planner Near Me

1.Define Your Financial Goals

Before searching for a financial planner, identify your financial objectives. Are you looking to save for retirement, buy a home, or create a college fund? Knowing your goals will help you find a CFP who specializes in the areas that matter most to you.

2.Search Locally and Online

Use online directories like the CFP Board’s “Find a CFP Professional” tool to locate certified planners near me. You can also ask friends, family, or colleagues for recommendations. Local searches are beneficial as they allow for in-person consultations and a better understanding of local financial regulations.

3.Verify Credentials

Always verify that the financial planner is certified. Look for the CFP designation, which signifies that the planner has completed rigorous training and adheres to ethical standards. Check their credentials on the CFP Board’s website or through other trusted certification organizations.

4.Evaluate Experience and Specializations

Different financial planners have expertise in various areas, such as retirement planning, estate planning, or investment management. Choose someone whose expertise aligns with your specific needs. Don’t hesitate to ask about their years of experience and the types of clients they typically work with.

5.Schedule Interviews

Interview multiple financial planners before making a decision. During the interview, ask questions such as:

- What services do you offer?

- How are you compensated (fee-only, commission-based, or a combination)?

- Can you provide references?

This process will help you assess their communication style, professionalism, and compatibility with your needs.

6.Consider Their Fee Structure

CFPs may charge fees in different ways: hourly rates, flat fees, or a percentage of assets under management. Ensure their fee structure is transparent and aligns with your budget. Fee-only planners are often recommended for their impartial advice, as they do not earn commissions from selling financial products.

7.Check Reviews and Testimonials

Look for online reviews and testimonials to gauge the reputation of the financial planner. Positive reviews and high ratings indicate reliability and trustworthiness. However, take overly negative reviews with a grain of caution and focus on consistent patterns in client feedback.

8.Trust Your Instincts

Your financial planner will play a significant role in your financial future. Ensure you feel comfortable discussing personal financial matters with them. Trust and transparency are key components of a successful client-planner relationship.

Red Flags to Watch Out For

While searching for a certified financial planner, be cautious of the following:

- Lack of certification or unverifiable credentials.

- High-pressure sales tactics.

- Unclear or hidden fee structures.

- Limited communication or unwillingness to answer questions.

Conclusion

Finding the best certified financial planner near me doesn’t have to be overwhelming. By following these steps, you can identify a qualified professional who understands your financial goals and can guide you toward achieving them. Remember to verify credentials, evaluate their expertise, and trust your instincts before making a decision. With the right CFP by your side, you can build a secure and prosperous financial future.

If you’re new to financial planning, check out our Beginner’s Guide to Financial Planning for foundational tips and insights