Table of Contents

Introduction

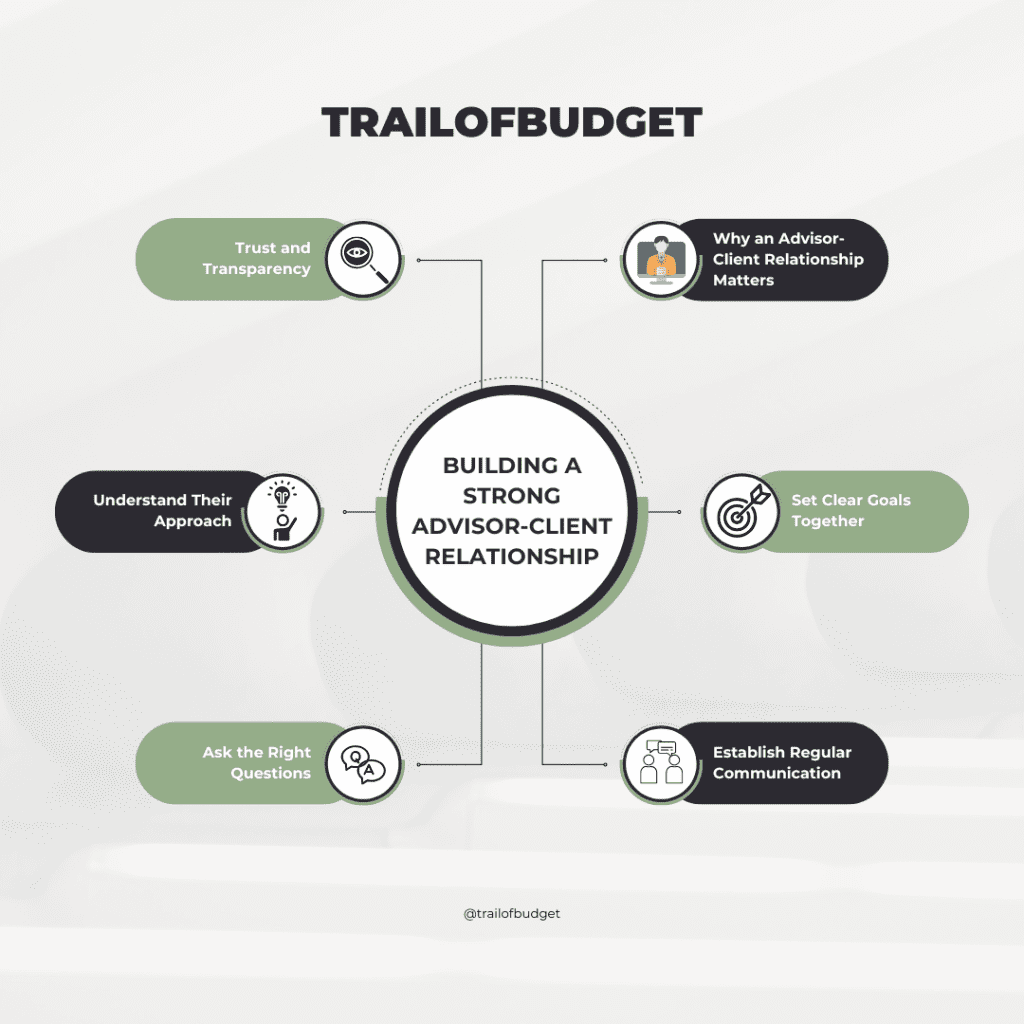

An effective advisor-client relationship is the cornerstone of achieving your financial goals. Whether you’re seeking guidance on investments, retirement planning, or overall financial health, a strong partnership with your financial advisor ensures you stay on track. In this guide, we’ll explore key strategies to establish trust, communication, and collaboration with your advisor for long-term success.

Why an Advisor-Client Relationship Matters

A solid advisor-client relationship goes beyond numbers. It creates a partnership where both parties work together toward shared financial goals. Your advisor becomes a trusted ally, providing insights, strategies, and support tailored to your unique situation.

Set Clear Goals Together

The foundation of any successful advisor-client relationship is mutual understanding. Start by clearly defining your financial objectives, such as saving for retirement, buying a home, or building an emergency fund. Communicate your goals in detail so your advisor can create a personalized plan that aligns with your aspirations.

Establish Regular Communication

Frequent and open communication strengthens the advisor-client relationship. Schedule regular check-ins to review your progress and adjust your plan as needed. Knowing how and when to contact your advisor ensures you stay informed and confident in your financial journey.

Ask the Right Questions

Don’t hesitate to ask questions to deepen your understanding of the financial strategies being proposed. Questions like:

- What are the potential risks of this investment?

- How does this plan align with my goals?

- Are there alternative strategies to consider?

Your engagement shows your commitment to the advisor-client relationship and ensures transparency.

Understand Their Approach

Every advisor has a unique approach to financial planning, shaped by their experience, expertise, and personal philosophy. Take the time to discuss their methodology, risk tolerance, and investment philosophy in detail. Understanding these aspects can help you gauge whether their strategies resonate with your financial goals and personal values. This clarity ensures that their approach not only aligns with your comfort level but also adapts to your evolving needs and long-term vision. A well-matched strategy builds trust and sets the foundation for a successful and collaborative advisor-client relationship.

Trust and Transparency

Trust is the backbone of the advisor-client relationship. Share relevant details about your financial situation honestly, and expect your advisor to provide transparent explanations about fees, performance, and decisions.

Stay Engaged

An advisor-client relationship thrives when both parties remain actively engaged and invested in the process. To make the most of your collaboration, attend meetings well-prepared with questions, updates, and insights about your financial situation. This proactive approach ensures that your advisor has all the necessary information to guide you effectively. Additionally, stay informed about market trends, economic shifts, and any changes that could impact your portfolio. Open communication and mutual involvement foster trust and help you work together to achieve your financial goals.

Use Resources and Tools

Leverage the tools and resources your advisor provides. These might include budgeting software, market analysis reports, or financial planning apps. Using these tools strengthens your collaboration and enhances the advisor-client relationship.

Outbound Link:

For more tips on financial planning and choosing the right advisor, visit Investopedia’s Guide to Financial Advisors.

Additional Resources

If you’re new to financial planning, check out our Beginner’s Guide to Financial Planning for foundational tips and insights

Conclusion

Building a strong advisor-client relationship requires time, effort, and a commitment to collaboration, but the rewards are well worth it. Through clear communication, mutual trust, and aligned goals, you can establish a partnership that empowers you to make informed financial decisions and achieve lasting success. This relationship serves as a foundation for navigating financial challenges and opportunities with confidence. Begin strengthening your advisor-client relationship today, and take proactive steps toward securing a brighter, more stable financial future.