Are you tired of living paycheck to paycheck or wondering where all your money goes? You’re not alone. Many people struggle with managing their finances, but the good news is that Budgeting Basics can help you regain control and achieve your financial goals. Understanding the fundamentals of budgeting, or what we call Budgeting Basics, empowers you to spend smarter and save for what truly matters. Let’s explore how you can create and maintain a budget that works for you.

Table of Contents

Why Budgeting Is Important:

The Budgeting Basics method allows you to track spending, save for your goals, and avoid debt.

- Track Spending: Understand exactly where your money is going.

- Save for Goals: Whether it’s a vacation, emergency fund, or retirement, a budget helps you allocate funds for your dreams.

- Avoid Debt: Spend within your means and stay out of financial trouble.

- Gain Peace of Mind: Feel confident about your financial future by knowing you have a plan.

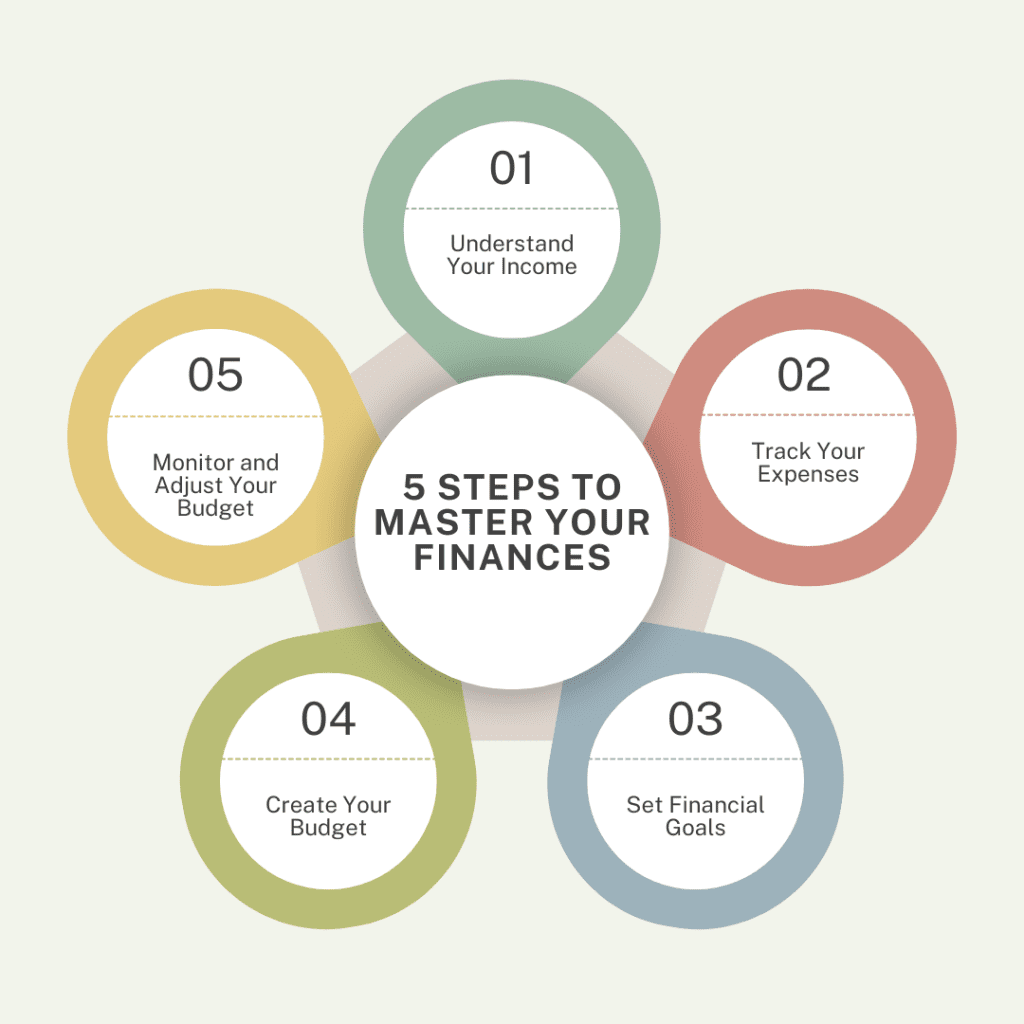

Step 1: Understand Your Income

Before diving into the details, ensure you grasp the Budgeting Basics for managing your income effectively.

- Primary Job: Your net pay (after taxes).

- Side Hustles: Any freelance work or gig income.

- Passive Income: Earnings from investments, dividends, or rental properties.

Knowing your exact income gives you a clear picture of what you have to work with.

Step 2: Track Your Expenses

Spend one month documenting every expense. Break your spending into categories:

- Fixed Expenses: Rent, mortgage, insurance, utilities, and subscriptions.

- Variable Expenses: Groceries, dining out, transportation, and entertainment.

- Irregular Expenses: Gifts, medical bills, or annual payments.

Once you’ve tracked your spending, analyze your habits. Are you overspending on non-essentials? Identifying patterns helps you spot areas for improvement.

Step 3: Set Financial Goals

Goals are essential to staying motivated.

- Short-Term Goals: Save for an emergency fund, pay off credit card debt, or fund a small trip.

- Long-Term Goals: Build retirement savings, purchase a home, or plan for your child’s education.

Write your goals down and assign a deadline for each one to stay focused.

Step 4: Create Your Budget

When following these Budgeting Basics, you’ll find it easier to allocate funds for your needs, wants, and savings. One popular method is the 50/30/20 Rule:

- 50% for Needs: Essentials like housing, groceries, and bills.

- 30% for Wants: Non-essentials like hobbies, dining out, or shopping.

- 20% for Savings: Emergency funds, debt repayment, or investments.

Adjust the percentages based on your specific needs and financial situation.

Step 5: Monitor and Adjust Your Budget

Budgets aren’t static. Regularly review your budget to ensure it aligns with your current financial situation.

- Use Tools: Apps like Mint, YNAB, or even spreadsheets can simplify tracking.

- Review Monthly: Reassess your budget at the end of each month to account for changes in income or expenses.

- Celebrate Wins: Meeting your financial goals? Treat yourself responsibly to stay motivated!

Common Budgeting Mistakes and How to Avoid Them

- Not Accounting for Irregular Expenses: Always set aside a small amount for unexpected costs.

- Overcomplicating the Process: Keep your budget simple and easy to follow.

- Not Sticking to the Plan: Stay disciplined but allow some flexibility for life’s surprises.

Conclusion:

By mastering the Budgeting Basics, you’re setting yourself up for long-term financial stability and freedom. By taking the time to understand your income, track expenses, set goals, and create a plan, you’ll be on the path to a brighter financial future. It’s not about denying yourself the things you love—it’s about making intentional choices with your money so you can enjoy both the present and the future.

A good budget helps you prepare for emergencies, invest in your dreams, and live with confidence knowing you’re in control of your finances. It’s also a journey that evolves with your life. Remember, budgeting isn’t about perfection—it’s about progress. Every small step you take today brings you closer to the financial security and freedom you deserve. Start now, and watch how even the smallest changes can make a big impact over time.

Ready to take the first step? Start tracking your expenses today and see how a budget can transform your life. Have tips or questions about budgeting? Share them in the comments—we’d love to hear from you!

Check out our 10 Practical Saving Money Tips for Beginners to Build Wealth it will help you in building your wealth.

2 thoughts on “Budgeting Basics: 5 Steps to Master Your Finances”